Recyclatanteil Explained and Why Recycled Content Matters

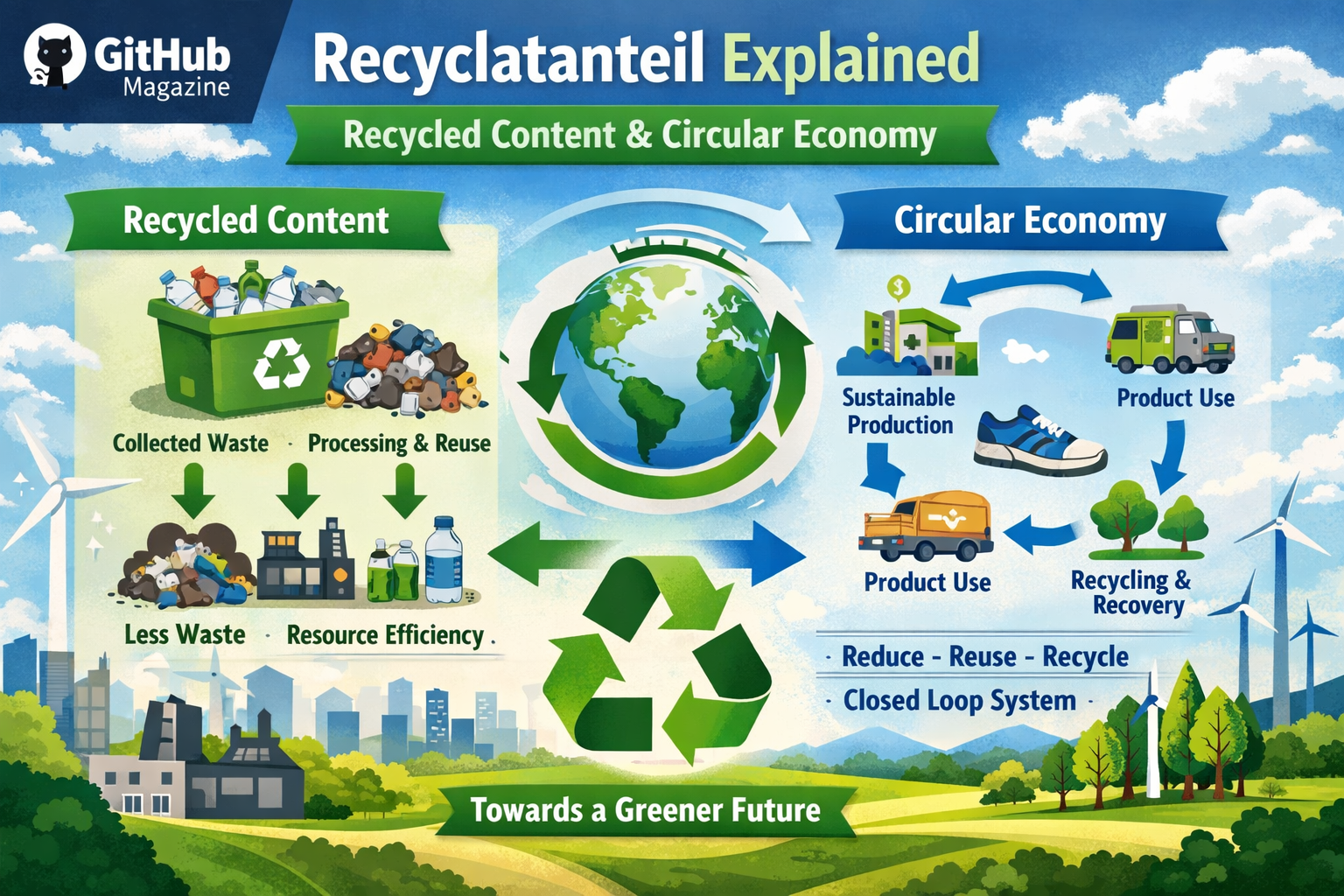

In environmental policy and corporate sustainability, a single metric is gaining quiet authority: Recyclatanteil. The German term refers to the proportion of recycled material used in new products or material streams. While recycling rates describe how much waste is collected and processed, Recyclatanteil answers a more consequential question: how much of that recovered material is actually reused in manufacturing.

Within the first moments of any sustainability discussion, this distinction reshapes the conversation. A country can report impressive recycling figures while continuing to rely almost entirely on virgin raw materials in production. In such cases, recycling becomes a logistical exercise rather than a structural transformation. Recyclatanteil exposes this gap between waste management and material reuse, showing whether circular economy principles exist on paper or in practice.

The concept has gained relevance as governments adopt circular economy frameworks, corporations publish sustainability reports, and consumers demand measurable environmental progress. A plastic bottle labeled “recyclable” says little about its environmental footprint if it contains no recycled material. A bottle made with 50 percent recycled polymer, however, directly reduces oil extraction, energy consumption, and greenhouse-gas emissions.

Across Europe, Asia, and North America, regulators increasingly consider recycled content targets alongside recycling quotas. Manufacturers, in turn, face growing pressure to secure stable supplies of high-quality recyclates. Understanding Recyclatanteil therefore means understanding the mechanics of modern sustainability itself: where waste goes, how materials circulate, and whether industrial systems are designed to regenerate resources rather than exhaust them.

What Recyclatanteil Really Means

Recyclatanteil describes the percentage of recycled material incorporated into a product or production process. A beverage bottle produced with 30 percent recycled polyethylene terephthalate has a Recyclatanteil of 30 percent. The remaining share comes from virgin fossil-based feedstock. This measurement applies across sectors, from packaging and construction to electronics and automotive manufacturing.

Unlike recycling rates, which track waste flows at the end of a product’s life, Recyclatanteil focuses on the beginning of the next one. It asks whether recovered materials reenter economic circulation in meaningful quantities. Without this step, recycling systems risk becoming symbolic rather than transformative, collecting waste but failing to displace resource extraction.

The metric also exposes structural inefficiencies. Large volumes of recyclable material may be exported, down-cycled into lower-value uses, or rejected due to contamination and inconsistent quality. Each of these outcomes lowers effective recycled content even when collection systems perform well. In this sense, Recyclatanteil operates as a diagnostic tool, highlighting weaknesses in sorting technologies, material standards, and industrial design.

For metals and glass, recycled content has long been integrated into production. Plastics remain more difficult. Their diversity, chemical sensitivity, and contamination risks complicate large-scale reuse. Yet it is precisely here that Recyclatanteil carries the most political and environmental significance, because plastic waste dominates public concern and regulatory debate.

Recycling Rates vs. Recyclatanteil: A Hard Comparison

| Metric | What It Measures | Strength | Limitation |

|---|---|---|---|

| Recycling rate | Percentage of waste collected and processed | Indicates waste diversion | Does not show reuse in products |

| Recyclatanteil | Percentage of recycled content in new products | Shows real circular material use | Complex to measure and verify |

| Recovery rate | Waste recovered including energy use | Broad system overview | Overstates material circularity |

In the European Union, plastic packaging recycling reached roughly 40 percent in the early 2020s. Yet the share of recycled plastic in new packaging remains substantially lower, often below 20 percent in many applications. The gap reflects export of waste, quality losses during processing, and limited demand from manufacturers constrained by technical standards.

Recyclatanteil therefore complements traditional indicators. Recycling rates tell policymakers whether waste is diverted from landfills. Recyclatanteil tells them whether that waste meaningfully replaces virgin resources. Without both, sustainability assessments remain incomplete.

Industrial Realities: Barriers and Breakthroughs

Manufacturers face three persistent barriers to increasing recycled content: quality, cost, and consistency. Virgin materials offer predictable chemical composition and mechanical properties. Recyclates vary widely depending on source material, contamination levels, and processing technology. For high-precision industries such as food packaging or medical devices, this variability creates regulatory and safety challenges.

Plastics illustrate the difficulty most clearly. Mixed polymers, additives, dyes, and food residues degrade recyclate quality. Mechanical recycling further shortens polymer chains, reducing durability. Chemical recycling promises to rebuild polymers at the molecular level, but remains energy-intensive and expensive at commercial scale.

Metals offer a contrasting narrative. Aluminum recycling uses roughly 5 percent of the energy required for primary smelting, making recycled aluminum economically attractive. As a result, most aluminum products contain significant recycled content, and nearly three-quarters of all aluminum ever produced is still in circulation.

Glass occupies a similar position. It can be recycled indefinitely without quality loss. Where collection systems are effective, recycled glass content often exceeds 60 percent in new bottles. These examples demonstrate that high Recyclatanteil is not merely theoretical but achievable when material properties and industrial infrastructure align.

Policy and Regulation: Mandating Recycled Content

European waste legislation increasingly shifts from collection targets toward output-based accounting. Amendments to the Waste Framework Directive in 2018 redefined recycling calculations to include only material that actually enters new production cycles. This change indirectly elevated the importance of recycled content, discouraging inflated statistics based on preliminary sorting alone.

Several governments now consider explicit minimum recycled-content requirements for packaging, construction materials, and automotive components. Such mandates aim to stabilize demand for recyclates, making investments in recycling infrastructure financially viable.

Industry response has been cautious but strategic. Major consumer-goods companies have announced voluntary targets of 25 to 50 percent recycled plastic content in packaging by the end of the decade. Automotive manufacturers increasingly specify recycled aluminum and steel in procurement contracts. These commitments transform Recyclatanteil from an abstract metric into a contractual obligation.

Policy, however, must navigate trade-offs. Food safety regulations restrict recycled plastic use in direct-contact packaging. Medical standards impose similar limitations. Economic disparities between regions further complicate global supply chains. A universal Recyclatanteil benchmark therefore remains politically difficult, even as momentum grows.

Global Perspectives: Variations and Trends

| Region | Typical recycling rate (plastics) | Recycled content trend | Structural notes |

|---|---|---|---|

| European Union | 40–45% | Increasing | Driven by packaging directives |

| United States | Around 9% | Low but growing | Heavy reliance on exports |

| Asia-Pacific | 10–20% | Rapid growth | Investment in sorting capacity |

Europe leads in regulatory coordination, using packaging directives and extended producer responsibility schemes to push recycled content. North America remains fragmented, with voluntary corporate commitments substituting for federal mandates. In Asia, infrastructure expansion dominates policy agendas, as urbanization produces vast new waste streams.

Automotive and electronics industries increasingly globalize recycled material procurement, signing long-term contracts with recyclers to secure feedstock. Such agreements signal a structural shift: recycled materials are no longer residual inputs but strategic resources.

Expert Insights on Recyclatanteil

“Recyclatanteil is the true litmus test of a circular economy, because it measures real material reuse, not just waste diversion,” notes a sustainability analyst writing in the Journal of Circular Economy Studies.

A materials scientist in Environmental Materials Review emphasizes the dual challenge: “Boosting recycled content requires both supply of quality recyclates and stable demand from manufacturers. Without either, markets collapse.”

From a regulatory perspective, an EU policy researcher observes, “Policy must align with market mechanisms to make recycled materials competitive with virgin feedstock. Targets alone are insufficient without investment in sorting technology and product redesign.”

Together, these perspectives frame Recyclatanteil as a systemic indicator, shaped as much by economics and engineering as by environmental ambition.

Takeaways

- Recyclatanteil measures recycled content, not waste collected.

- High recycling rates do not guarantee material circularity.

- Metals and glass demonstrate the feasibility of high recycled content.

- Plastics remain constrained by quality and safety limitations.

- Policy increasingly targets recycled content, not only recycling volumes.

- Stable demand is essential for functioning recyclate markets.

Conclusion

Recyclatanteil captures a fundamental shift in how sustainability is evaluated. It moves attention from bins and trucks to factories and supply chains, from waste management to resource design. Recycling alone does not create a circular economy. Only when recycled materials replace virgin inputs at scale does environmental benefit become structurally embedded.

Progress remains uneven. Metals and glass approach mature circular systems, while plastics struggle under technical and regulatory weight. Yet the metric itself has altered expectations. Governments reference it in legislation, corporations include it in annual reports, and consumers increasingly recognize its significance.

In this sense, Recyclatanteil functions as both measurement and mirror. It reflects how seriously societies treat the promise of circularity. Where recycled content rises, resource extraction slows, emissions fall, and waste becomes raw material. Where it stagnates, sustainability remains largely symbolic.

The future of material stewardship will not be determined solely by how much waste is collected, but by how deeply recycled matter is woven into the fabric of production.

FAQs

What does Recyclatanteil mean?

It refers to the percentage of recycled material used in manufacturing a product or material stream.

Is it the same as the recycling rate?

No. Recycling rate measures waste processed, while Recyclatanteil measures recycled content in new products.

Why is it important for sustainability?

Because it shows whether recycled materials replace virgin resources, reducing emissions and extraction.

Which industries use high recycled content?

Aluminum, steel, and glass industries often achieve high Recyclatanteil due to material properties.

Can governments require recycled content?

Yes. Some regions already mandate minimum recycled content in packaging and construction materials.